What is the Annual Compliance for Private Company?

A Private Company is a unique entity that needs to stay active by filing regular reports with the MCA. Each financial year, companies are required to file an annual return and audited financial statements with the MCA, regardless of turnover or transaction volume. Failure to comply with these annual compliances can lead to the company's name being removed from the RoC register and its directors being disqualified. The MCA has taken proactive measures to address non-compliance issues and ensure that companies meet their filing obligations. The due dates for annual filing depend on the date of the Annual General Meeting, and both forms report the activities and financial data for the relevant financial year.

Benefits of Annual Compliance

Raising Company’s Credibility

In order to maintain credibility, it is essential for businesses to comply with the law. The annual return filing date for a company can be found on the MCA portal's Master Data. Compliance is a major factor in measuring the credibility of an organization, as it is necessary for government tenders, loan approvals, and other similar purposes.

Attract Investors

When a company wants to attract investors, those investors usually want to see all the financial records and data before they make up their minds. They can get that info by contacting the company directly or by checking the MCA portal. The investors prefer to deal with companies that have a good history of following the rules and meeting their annual compliance obligations.

Maintain Active Status and avoid penalties

If a company continuously fails to file its annual return, it will be categorized as default and will incur heavy penalties. The company may also be declared defunct or removed from the RoC register, and the directors may be disqualified and barred from further appointments. Since July 2018, a penalty of ₹100 per day will be charged for each day of delay until the date of filing.

Documents required for Annual Filing of company

Incorporation Document

PAN Card, Certificate of Incorporation and MoA – AoA of Private Company

Audited Financial Statements

Financial Statements must be audited by independent auditor

Audit Report & Board Report

Independent auditor’s report and Board report must be provided

DSC of Director

Valid and active DSC of one of the directors must be provided

Due Dates of compliance for Private Limited Company

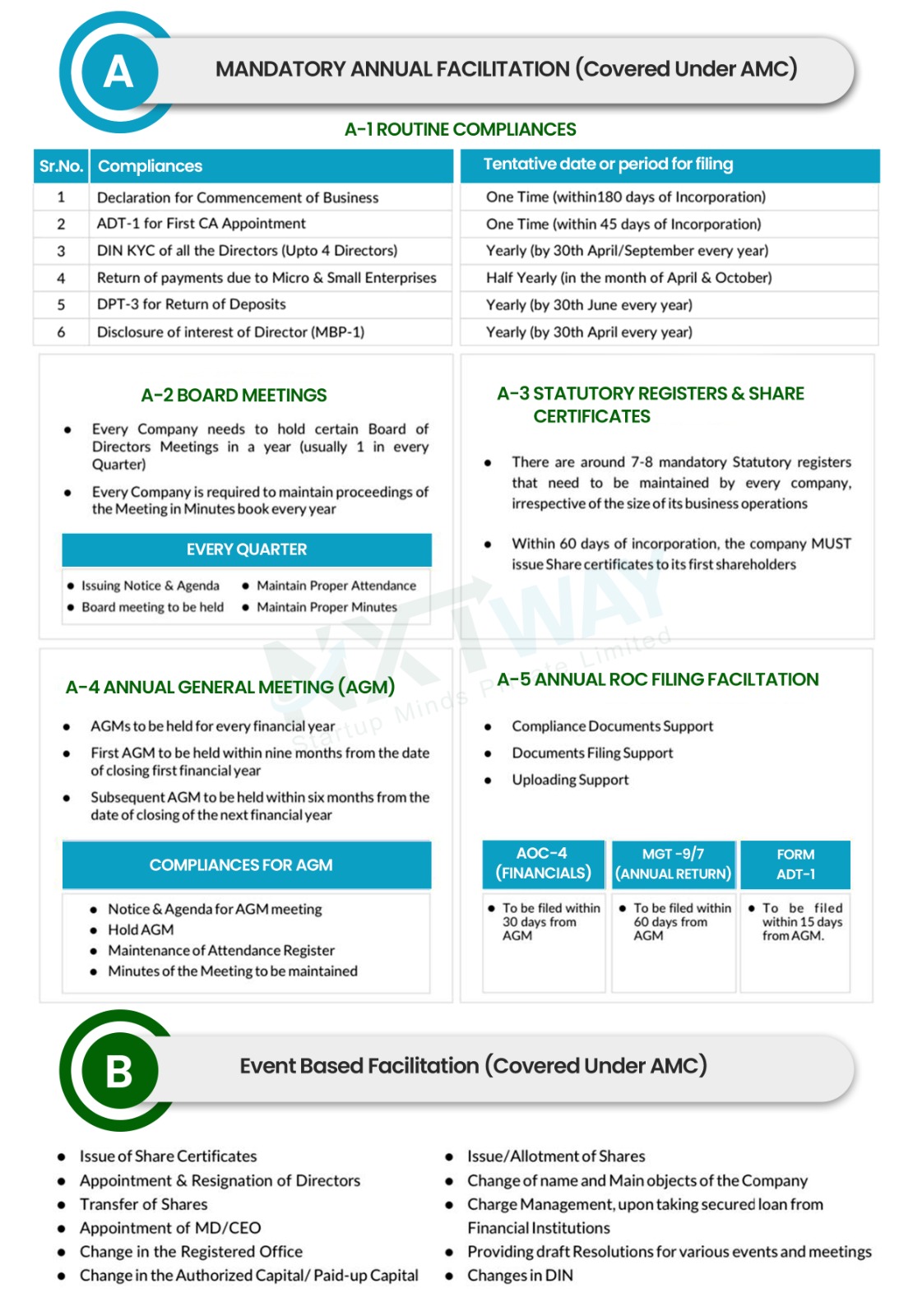

AOC - 4 (Financial Statement)

Within 30 days from the date of AGM

MGT - 7 (Annual Return)

Within 60 days from the date of AGM

Fulfil compliance in 3 Easy Steps

1. Answer Quick Questions- Spare less than 10 minutes to fill our online Questionnaire

- Upload required Documents

- Make quick payment through our secured gateways

- Assigned Relationship Manager

- Drafting of required documents for filing

- Preparation of Forms to be filed

- Online Filing of Financial Statement and other documents

- Online Filing of Annual Return of company

- All it takes is 5 working days*

Process of Annual filing of company

Day 1 - Collection- Discussion and collection of basic Information

- Provide Required Documents

- Decide the due dates of ROC filing for Pvt. Ltd. Company

- Drafting necessary documents

- Attachment of supporting documents

- Filing of AOC – 4 (Financial Statements)

- Filing of MGT – 7 (Annual Return)